Nation’s Oldest Biotech Hubs Looking at NC as One of Their Biggest Rivals

(Axios – Zachery Eanes) — In less than a decade, the Triangle’s biotech industry has more than doubled its lab space and added tens of thousands of new workers, as the region’s profile among investors and companies soars.

The big picture: Some of the nation’s oldest biotech hubs, like Boston, now see the Triangle as one of their biggest rivals, as a widely shared Boston Globe article noted this month.

- That’s because the region not only boasts a talented workforce but also continues to offer comparatively low costs for land, construction, electricity, lab rent and housing, the Globe reported.

Why it matters: The biotech industry has long driven the Triangle’s growth, making Research Triangle Park a name brand across the country. From scientists with advanced degrees to community college graduates working in pharmaceutical manufacturing, the high-paying jobs abound.

- And even as investments into office buildings slow down, the building boom in the life sciences industry remains robust.

By the numbers: Around 40,000 people in the Triangle worked in the life sciences industry as of 2022, a significant increase over the past decade, according to research from CBRE.

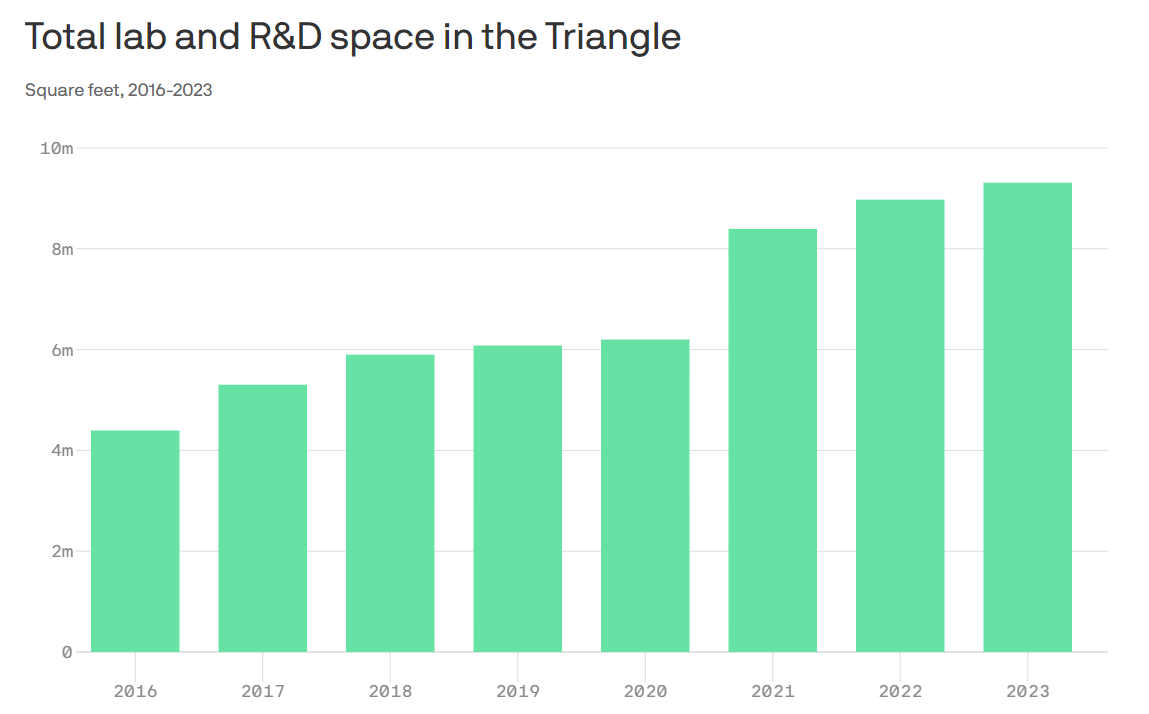

- From 2016 to 2023, lab and R&D space grew from 4.4 million square feet to 9.3 million square feet.

- Since 2018, nearly 30 life sciences companies, like Fujifilm Diosynth and Eli Lilly, have invested $8.9 billion in the region, and pledged to create nearly 7,000 new jobs.

Zoom in: Research Triangle Park, home to hundreds of companies and where a $1.5 billion development effort is underway, is the epicenter of the Triangle’s biotech industry.

- But it’s influence has seeped into every corner of the region, with downtown Durham now a hot spot for startups, and manufacturing hubs for pharma companies popping up from southern Wake County all the way to Sanford.

- Chapel Hill and Raleigh are also seeing upticks in lab space construction.

Among the biggest projects underway:

- Spark Life Science in Morrisville, which could span 1.5 million square feet of lab and manufacturing space. The first phase has been completed, with no tenants signed yet.

- Pathway Triangle, a 1 million square foot manufacturing campus under construction across the street from Spark LS, is currently being built by Boston-based King Street Properties.

- Via Labs, which will be Hub RTP’s first lab high-rise, could start construction later this year — though Boston-based owner Longfellow is still waiting to sign tenants.

- Fujifilm Diosynth’s $2 billion manufacturing campus in Holly Springs will be completed in 2025. Janssen Supply Group recently signed a lease there as well.

Between the lines: The growth simply wouldn’t be happening without the presence of three tier-one research universities, Lee Clyburn, executive vice president at CBRE’s Raleigh office, told Axios.

- In 2023 alone, Duke, UNC, the Research Triangle Institute and others brought in $1.9 billion in National Institute of Health funding.

- And thanks to the universities, the Triangle boasts one of the highest concentrations of life science researchers in the country.

Threat level: With so much lab and manufacturing space on the way, vacancy rates are expected to rise, CBRE noted, and already they are hovering around 10%.

- A combination of higher interest rates and a slowdown in venture capital funding could slow down the industry’s growth in the Triangle as well.

- Forge Nano — a battery company, not a life sciences company — was the only major manufacturing lease in the four quarter of 2023.

Yes, but: The real estate firm JLL also recently named the Triangle as the No. 1 biomanufacturing market in the country.

- And JLL notes that the Triangle’s pipeline of construction, while large, is not as speculative as markets like Boston or the Bay Area.

What’s next: Novo Nordisk, the Danish pharmaceutical company behind the weight-loss drug Ozempic, could be the next life sciences company to plot a Triangle expansion.

- The company has purchased an additional 163 acres around its facility in Johnston County and filed permits for an expansion of its Durham County manufacturing facility, CBRE noted.